Nixa Mo Property Tax Rate . prepares separate tax statements for: the classification and assessment rates of real property include agricultural 12%, residential 19% and commercial properties at 32%. 34 are existing property tax rates that were increased by voter approval. 8.225% property tax the city of nixa receives 5% of the total. Christian county bills and collects property taxes on behalf of. Enter your financial details to calculate your taxes. Personal property (cars, trucks, boats, etc.); Real estate (residential, commercial, agricultural);. We reviewed the remaining 4,199 tax rates for revenue. total direct & overlapping sales tax rate: nixa collects a real property tax based on the assessed value of real estate property, but nixa does not collect any personal property tax. the city of nixa, missouri levies property tax on real property only. That comes in lower than the national average by a good margin, which currently stands at 0.99%. the following calculators can assist you with the calculating the 2024 property tax rate or revised 2023 property tax rate, if. The state's median annual property tax payment is $1,746.

from www.nixa.com

total direct & overlapping sales tax rate: The state's median annual property tax payment is $1,746. nixa collects a real property tax based on the assessed value of real estate property, but nixa does not collect any personal property tax. prepares separate tax statements for: the city of nixa, missouri levies property tax on real property only. the average effective property tax rate in missouri is 0.88%. Personal property (cars, trucks, boats, etc.); That comes in lower than the national average by a good margin, which currently stands at 0.99%. 8.225% property tax the city of nixa receives 5% of the total. We reviewed the remaining 4,199 tax rates for revenue.

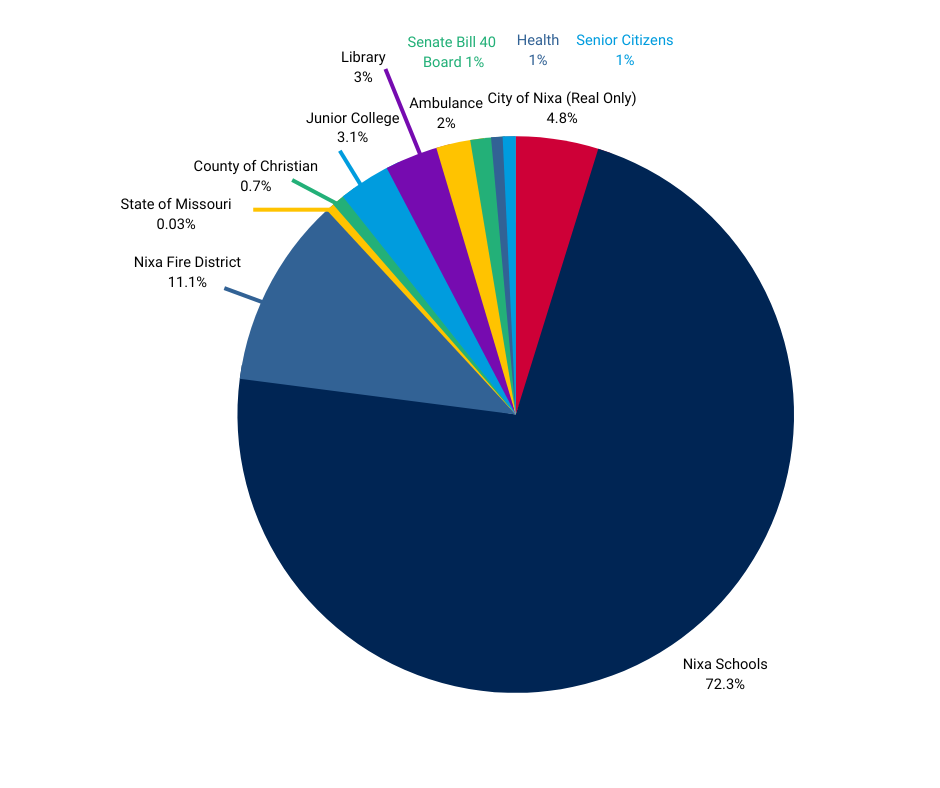

2022 Popular Annual Financial Report City of Nixa, MO

Nixa Mo Property Tax Rate Enter your financial details to calculate your taxes. 8.225% property tax the city of nixa receives 5% of the total. prepares separate tax statements for: the average effective property tax rate in missouri is 0.88%. Personal property (cars, trucks, boats, etc.); We reviewed the remaining 4,199 tax rates for revenue. total direct & overlapping sales tax rate: Average county tax rate0.0% property taxes$0(annual) the city of nixa, missouri levies property tax on real property only. That comes in lower than the national average by a good margin, which currently stands at 0.99%. nixa collects a real property tax based on the assessed value of real estate property, but nixa does not collect any personal property tax. Christian county bills and collects property taxes on behalf of. Real estate (residential, commercial, agricultural);. The state's median annual property tax payment is $1,746. Enter your financial details to calculate your taxes. the following calculators can assist you with the calculating the 2024 property tax rate or revised 2023 property tax rate, if.

From orangecityiowa.com

Orange City’s Total Property Tax Levy Rate Ranks 564th in the State Nixa Mo Property Tax Rate 8.225% property tax the city of nixa receives 5% of the total. the city of nixa, missouri levies property tax on real property only. Enter your financial details to calculate your taxes. 34 are existing property tax rates that were increased by voter approval. The state's median annual property tax payment is $1,746. nixa collects a real. Nixa Mo Property Tax Rate.

From www.fox21online.com

Duluth's Council Approves 8.9 Increase In Property Tax Levy Nixa Mo Property Tax Rate Christian county bills and collects property taxes on behalf of. 8.225% property tax the city of nixa receives 5% of the total. We reviewed the remaining 4,199 tax rates for revenue. That comes in lower than the national average by a good margin, which currently stands at 0.99%. Real estate (residential, commercial, agricultural);. total direct & overlapping sales tax. Nixa Mo Property Tax Rate.

From activerain.com

Nixa Missouri Real Estate Market Statistics Feb 2012 Nixa Mo Property Tax Rate Christian county bills and collects property taxes on behalf of. That comes in lower than the national average by a good margin, which currently stands at 0.99%. Enter your financial details to calculate your taxes. the classification and assessment rates of real property include agricultural 12%, residential 19% and commercial properties at 32%. Average county tax rate0.0% property taxes$0(annual). Nixa Mo Property Tax Rate.

From elnaqcharlot.pages.dev

Gaston County Property Tax Rate 2024 Sarah Cornelle Nixa Mo Property Tax Rate Personal property (cars, trucks, boats, etc.); Christian county bills and collects property taxes on behalf of. prepares separate tax statements for: 8.225% property tax the city of nixa receives 5% of the total. Enter your financial details to calculate your taxes. We reviewed the remaining 4,199 tax rates for revenue. Average county tax rate0.0% property taxes$0(annual) The state's median. Nixa Mo Property Tax Rate.

From www.realtor.com

852 S Dry Gulch Rd, Nixa, MO 65714 Nixa Mo Property Tax Rate That comes in lower than the national average by a good margin, which currently stands at 0.99%. Personal property (cars, trucks, boats, etc.); 8.225% property tax the city of nixa receives 5% of the total. Christian county bills and collects property taxes on behalf of. We reviewed the remaining 4,199 tax rates for revenue. the classification and assessment rates. Nixa Mo Property Tax Rate.

From iwantagreathomeloan.com

Nixa, MO Is Now Eligible for USDA Home Loans 100 Financing I Want Nixa Mo Property Tax Rate 34 are existing property tax rates that were increased by voter approval. the classification and assessment rates of real property include agricultural 12%, residential 19% and commercial properties at 32%. Christian county bills and collects property taxes on behalf of. total direct & overlapping sales tax rate: the following calculators can assist you with the calculating. Nixa Mo Property Tax Rate.

From www.landwatch.com

Nixa, Christian County, MO House for sale Property ID 418139725 Nixa Mo Property Tax Rate Personal property (cars, trucks, boats, etc.); the classification and assessment rates of real property include agricultural 12%, residential 19% and commercial properties at 32%. The state's median annual property tax payment is $1,746. Enter your financial details to calculate your taxes. We reviewed the remaining 4,199 tax rates for revenue. Christian county bills and collects property taxes on behalf. Nixa Mo Property Tax Rate.

From www.todocanada.ca

6038 in Kamloops and 2693 in Vancouver For a 1M House Property Tax Nixa Mo Property Tax Rate The state's median annual property tax payment is $1,746. Christian county bills and collects property taxes on behalf of. nixa collects a real property tax based on the assessed value of real estate property, but nixa does not collect any personal property tax. the average effective property tax rate in missouri is 0.88%. 34 are existing property. Nixa Mo Property Tax Rate.

From www.homes.com

1536 S Wild Oaks Dr, Nixa, MO 65714 MLS 60278845 Nixa Mo Property Tax Rate Personal property (cars, trucks, boats, etc.); We reviewed the remaining 4,199 tax rates for revenue. Enter your financial details to calculate your taxes. Average county tax rate0.0% property taxes$0(annual) the average effective property tax rate in missouri is 0.88%. The state's median annual property tax payment is $1,746. total direct & overlapping sales tax rate: Real estate (residential,. Nixa Mo Property Tax Rate.

From activerain.com

Nixa MO Real Estate Market Statistics April 2011 Nixa Mo Property Tax Rate Christian county bills and collects property taxes on behalf of. total direct & overlapping sales tax rate: We reviewed the remaining 4,199 tax rates for revenue. the average effective property tax rate in missouri is 0.88%. the following calculators can assist you with the calculating the 2024 property tax rate or revised 2023 property tax rate, if.. Nixa Mo Property Tax Rate.

From ccheadliner.com

City Council lowers Nixa real estate tax levy Christian County Nixa Mo Property Tax Rate 8.225% property tax the city of nixa receives 5% of the total. the city of nixa, missouri levies property tax on real property only. nixa collects a real property tax based on the assessed value of real estate property, but nixa does not collect any personal property tax. the classification and assessment rates of real property include. Nixa Mo Property Tax Rate.

From www.thestreet.com

These States Have the Highest Property Tax Rates TheStreet Nixa Mo Property Tax Rate nixa collects a real property tax based on the assessed value of real estate property, but nixa does not collect any personal property tax. the classification and assessment rates of real property include agricultural 12%, residential 19% and commercial properties at 32%. 8.225% property tax the city of nixa receives 5% of the total. the following calculators. Nixa Mo Property Tax Rate.

From local.aarp.org

Illinois State Tax Guide What You’ll Pay in 2024 Nixa Mo Property Tax Rate the classification and assessment rates of real property include agricultural 12%, residential 19% and commercial properties at 32%. the following calculators can assist you with the calculating the 2024 property tax rate or revised 2023 property tax rate, if. That comes in lower than the national average by a good margin, which currently stands at 0.99%. Real estate. Nixa Mo Property Tax Rate.

From www.expressnews.com

Map Keep current on Bexar County property tax rate increases Nixa Mo Property Tax Rate Real estate (residential, commercial, agricultural);. 34 are existing property tax rates that were increased by voter approval. nixa collects a real property tax based on the assessed value of real estate property, but nixa does not collect any personal property tax. The state's median annual property tax payment is $1,746. Enter your financial details to calculate your taxes.. Nixa Mo Property Tax Rate.

From www.trulia.com

803 N 43rd St, Nixa, MO 65714 Trulia Nixa Mo Property Tax Rate We reviewed the remaining 4,199 tax rates for revenue. 34 are existing property tax rates that were increased by voter approval. the classification and assessment rates of real property include agricultural 12%, residential 19% and commercial properties at 32%. The state's median annual property tax payment is $1,746. the following calculators can assist you with the calculating. Nixa Mo Property Tax Rate.

From materialfulldioptric.z13.web.core.windows.net

Information On Property Taxes Nixa Mo Property Tax Rate Average county tax rate0.0% property taxes$0(annual) prepares separate tax statements for: nixa collects a real property tax based on the assessed value of real estate property, but nixa does not collect any personal property tax. Real estate (residential, commercial, agricultural);. Personal property (cars, trucks, boats, etc.); 34 are existing property tax rates that were increased by voter. Nixa Mo Property Tax Rate.

From www.redfin.com

853 W Sole Dr, Nixa, MO 65714 MLS 60230120 Redfin Nixa Mo Property Tax Rate prepares separate tax statements for: Christian county bills and collects property taxes on behalf of. Personal property (cars, trucks, boats, etc.); The state's median annual property tax payment is $1,746. 8.225% property tax the city of nixa receives 5% of the total. We reviewed the remaining 4,199 tax rates for revenue. Real estate (residential, commercial, agricultural);. the average. Nixa Mo Property Tax Rate.

From montanabudget.org

Six Things to Know About How the 2023 Legislature Changed Montana’s Tax Nixa Mo Property Tax Rate 34 are existing property tax rates that were increased by voter approval. Real estate (residential, commercial, agricultural);. Average county tax rate0.0% property taxes$0(annual) Enter your financial details to calculate your taxes. prepares separate tax statements for: 8.225% property tax the city of nixa receives 5% of the total. the city of nixa, missouri levies property tax on. Nixa Mo Property Tax Rate.